Top Story

WLI Singapore Honestly Speaking with Chong Siak Ching and Ong Choon Fah

This series comprises engaging sessions where ULI invites inspiring women leaders in the real estate industry to share their journey.

28 February 2022

Arup Singapore

From tenants to developers, government to consultants, Singapore’s built environment sector will need to engage all stakeholders to decide what measurements are needed to assess an asset for readapting and rebuilding and when in the lifecycle of the building should the decision made, says speakers of this workshop.

How can we peel back the complexities of readapting and rebuilding real estate assets to help the built environment industry in Singapore make better informed considerations?

With the industry accountable for almost 40% of energy-related carbon emissions worldwide, there is increasing awareness of the environmental case and importance to readapt our cities’ real estate assets. Yet across Singapore, sentiments lean towards redevelopment – with the economics preferential to demolishing and rebuilding, , and according to speakers the market as of now dictating that it is cheaper option of the two. Where trends point to a preference for the brand new, how can the industry show that second hand does not mean second rate?

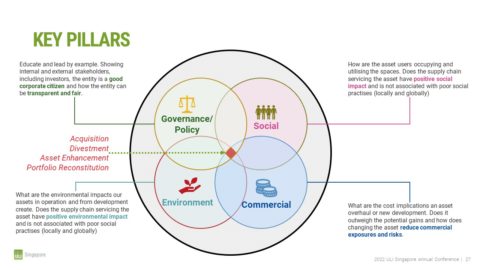

As part of the 2022 ULI Annual Conference in Singapore, ULI Singapore organised a workshop exploring the dichotomy between readapting and rebuilding – facilitated by Kabi Subramaniam, Regional Asset Services Leader in Arup, Stephen Bruce, Executive Director and Head of Real Estate Management from Colliers, and Viola Chee, Managing Director, Finance, at 8M Real Estate. 30 delegates from the across industry were brought together to explore considerations and challenges. Through case studies, key drivers beyond environmental factors into the commercial, governance and socio-cultural were also discussed, to catalyse stronger business cases for readapting.

From a design and engineering perspective, Mr Subramaniam highlights that along with the environmental advantages, readapting often delivers greater commercial and social returns to the owner of the development and drivers of change:

– Embodied and whole-life carbon

– Programme

– Capital cost

– Construction impact

– Heritage and community

– Circular economy

However, he stresses on time– and the importance of determining at which stage of the lifecycle of the building should developers start to consider enhancing the value of their real estate assets. Can opportunities be designed in, or be identified during earlier stages of the building’s lifecycle instead of at the end of its economic life?

Economic motivations to readapting were discussed as potential cost saving measures. According to Mr Bruce, readapting is going to cost more upfront, but the construction programme is going to be much shorter, and the property can be brought out to market quicker.

Moreover, it was raised during a discussion that we are sitting at the cusp of change, where labour and material supplies are low and are going to get more expensive over time. The investment made into new buildings by developers and investors will eventually trickle down to tenants and purchasers.

However, investors and developers would need more support and flexibility from banks. Ms Chee notes that perhaps a shift in attitudes towards green loan approvals for shophouses are needed. She notes from experience that three years ago, banks did not deem shophouses suitable for green loans because there was not much addition and alteration work that could be done. After all, repurposing an existing shophouse in and of itself is already a green act.

Whole-of-industry approach needed

While government and developer entities are studying the regulatory framework to adaptive reuse, it was highlighted that there is currently no government body in Singapore that is responsible for measuring the costs and benefits to rebuilding and readapting.

Suggestions such as having a moratorium, to tweaks made to lease renewal, to change of use, to incentives for developers to readapt their assets, even to a demand-based conversation to provide reliefs to tenants, were also discussed. However, many participants agreed that the industry first has to come together to decide what these measurements are and where the importance and focus on are on what the industry is measuring.

Ultimately, speakers acknowledge that conservations might already be happening behind closed doors. But to bring shift mindsets and reframe parameters about the economic life of a real estate asset, what the industry needs is are open, balanced and frank engagements and conversations covering multiple stakeholders’ perspectives from the groups.

ULI Singapore thanks Arup for hosting this workshop. For further enquiries, please email [email protected].

Don’t have an account? Sign up for a ULI guest account.